Influence of Perceived Ease of Use and Perceived Usefulness towards Continuance Intention with Customer Satisfaction as Intervening Variable: a study of Startup Companies Using e-Wallet

DOI:

https://doi.org/10.59653/jbmed.v2i02.669Keywords:

Perceived Ease of Use, Perceived Usefulness, Customer Satisfaction, Continuance Intention, Continuance Intention, e-WalletAbstract

The use of e-wallets is increasingly needed by entrepreneurs to improve their business performance. This study aims to examine and analyze the effect of perceived ease of use on perceived usefulness, customer satisfaction, and continuance intention. This research was conducted on students who own businesses and use e-wallets to operate their businesses. The sampling technique used was purposive sampling. Respondents used in this study amounted to 85 people. Data analysis using SEM-PLS. The results of the study found that Perceived Ease of Use has a significant effect on Customer Satisfaction, Perceived Ease of Use has no significant effect on Continuance Intention, Perceived Usefulness has a significant effect on Customer Satisfaction, Perceived Usefulness has no significant effect on Continuance Intention, and Customer Satisfaction has a significant effect on Continuance Intention. The results of this study suggest that e-wallet companies increase customer satisfaction because they play an important role in linking Perceived Ease of Use and Perceived Usefulness to Continuance Intention.

Downloads

References

Abdul-Halim, N. A., Vafaei-Zadeh, A., Hanifah, H., Teoh, A. P., & Nawaser, K. (2022). Understanding the determinants of e-wallet continuance usage intention in Malaysia. Quality and Quantity, 56(5), 3413–3439. https://doi.org/10.1007/s11135-021-01276-7

Bhattacherjee, A. (2001). Understanding Information Systems Continuance: An Expectation-Confirmation Model. In Source: MIS Quarterly (Vol. 25, Issue 3).

bi.go.id. (2022). Statistik Sistem Pembayaran dan Infrastruktur Pasar Keuangan (SPIP). Bi.Go.Id. https://www.bi.go.id/id/statistik/ekonomi-keuangan/spip/default.aspx

Brahanta, GP, & Wardhani, NIK (2021). The Influence of Perceptions of Usefulness, Convenience, Risk on Interest in Reusing Shopeepay in Surabaya. Unsera Journal of Management , 7 (2), 97–108.

Chaveesuk, S., Khalid, B., & Chaiyasoonthorn, W. (2022). Continuance intention to use digital payments in mitigating the spread of COVID-19 virus. International Journal of Data and Network Science , 6 (2), 527–536. https://doi.org/10.5267/j.ijdns.2021.12.001

Daragmeh, A., Sági, J., & Zéman, Z. (2021). Continuous intention to use e-wallet in the context of the covid-19 pandemic: Integrating the health belief model (hbm) and technology continuous theory (tct). Journal of Open Innovation: Technology, Market, and Complexity, 7(2). https://doi.org/10.3390/joitmc7020132

Davis, F. D. (1989). Perceived Usefulness, Perceived Ease of Use, and User Acceptance of Information Technology. MIS Quarterly, 319–340.

Ekarina. (2020). Pembayaran Nontunai Makin Akan Banyak Digunakan Setelah Pandemi. Katadata.Co.Id. https://katadata.co.id/ekarina/brand/5fa3754f05503/pembayaran-nontunai-makin-akan-banyak-digunakan-setelah-pandemi

Foroughi, B., Iranmanesh, M., & Hyun, S. S. (2019). Understanding the determinants of mobile banking continuance usage intention. Journal of Enterprise Information Management, 32(6), 1015–1033. https://doi.org/10.1108/JEIM-10-2018-0237

Garrouch, K. (2021). Does the reputation of the provider matter? A model explaining the continuance intention of mobile wallet applications. Journal of Decision Systems, 30(2–3), 150–171. https://doi.org/10.1080/12460125.2020.1870261

Ghozali, I., & Latan, H. (2015). Partial Least Square Konsep, Teknik dan Aplikasi menggunakan Program SmartPLS 3.0 (2nd ed.). Badan Penerbit Universitas Diponegoro.

Gupta, A., Yousaf, A., & Mishra, A. (2020). How pre-adoption expectancies shape post-adoption continuance intentions: An extended expectation-confirmation model. International Journal of Information Management, 52. https://doi.org/10.1016/j.ijinfomgt.2020.102094

Hossain, M. A., Hossain, M. S., & Jahan, N. (2018). Predicting continuance usage intention of mobile payment: An experimental study of bangladeshi customers. Asian Economic and Financial Review, 8(4), 487–498. https://doi.org/10.18488/journal.aefr.2018.84.487.498

Humbani, M., & Wiese, M. (2019). An integrated framework for the adoption and continuance intention to use mobile payment apps. International Journal of Bank Marketing, 37(2), 646–664. https://doi.org/10.1108/IJBM-03-2018-0072

Karim, M. W., Chowdhury, M. A. M., & Haque, A. A. (2022). A Study of Customer Satisfaction Towards E-Wallet Payment System in Bangladesh. American Journal of Economics and Business Innovation, 1(1), 1–10.

Kotler, P., & Keller, K. L. (2016). Marketing Management (15th ed.). Pearson Education Inc.

Le, T. T., Pham, H. M., Chu, N. H., Nguyen, D. K., & Ngo, H. M. (2020). Factors Affecting Users’ Continuance Intention towards Mobile Banking In Vietnam. American Journal of Multidisciplinary Research & Development (AJMRD, 2(4), 42–51. www.ajmrd.com

Liao, C., Palvia, P., & Chen, J. L. (2009). Information technology adoption behavior life cycle: Toward a Technology Continuance Theory (TCT). International Journal of Information Management, 29(4), 309–320. https://doi.org/10.1016/j.ijinfomgt.2009.03.004

Othman, A. K., Hamzah, M. I., & Abu Hassan, L. F. (2020). Modeling the contingent role of technological optimism on customer satisfaction with self-service technologies: A case of cash-recycling ATMs. Journal of Enterprise Information Management, 33(3), 559–578. https://doi.org/10.1108/JEIM-09-2019-0295

Phuong, N. N. D., Luan, L. T., Dong, V. Van, & Khanh, N. L. N. (2020). Examining customers’ continuance intentions towards e-wallet usage: The emergence of mobile payment acceptance in Vietnam. Journal of Asian Finance, Economics and Business, 7(9), 505–516. https://doi.org/10.13106/JAFEB.2020.VOL7.NO9.505

Puspitasari, I., Wiambodo, A. N. R., & Soeparman, P. (2021). The impact of expectation confirmation, technology compatibility, and customer’s acceptance on e-wallet continuance intention. AIP Conference Proceedings, 2329. https://doi.org/10.1063/5.0042269

Saibaba, S. (2022). An Empirical Model of Continuance Intention toward Mobile Wallet Services in India. Indian Journal of Commerce & Management Studies, XIII(3), 01–10. https://doi.org/10.18843/ijcms/v13i3/01

Tekaqnetha, G., & Rodhiah, R. (2020). Faktor Yang Mempengaruhi Continuance Intention GO-PAY Di Jakarta. Jurnal Manajerial Dan Kewirausahaan, 2(1), 173. https://doi.org/10.24912/jmk.v2i1.7457

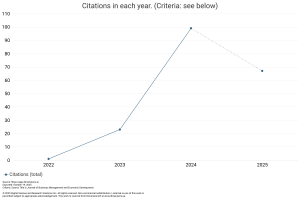

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Delvi Novira, Humam Santosa Utomo, Indro Herry Mulyanto

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Authors who publish with this journal agree to the following terms:

- Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution-ShareAlike that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgement of its initial publication in this journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See The Effect of Open Access).