How A Locus Of Control, Financial Learning Quality, And Financial Self-Efficacy Affect Financial Management Behavior

DOI:

https://doi.org/10.59653/jemls.v2i01.316Keywords:

Quality of Financial Learning, Financial Self-Efficacy, Locus of Control, Financial Management BehaviorAbstract

The purpose of this study was to determine how the quality of financial learning of accounting students in Bandung City is influenced by locus of control, level of financial independence, and quality of financial learning. This research uses the Behavioral finance theory approach. The type of research chosen is quantitative descriptive method. The data collected for this study came from questionnaires distributed using purposive sampling method. A total of 100 respondents were undergraduate accounting students studying in Bandung in 2018 and 2019. Data analysis methods include multiple linear regression and IBM SPSS version 25. The results showed that the quality of financial learning and financial self-efficacy partially had a significant effect on financial management behavior, while locus of control had no significant effect on financial management behavior. However, simultaneously the quality of financial learning, financial self-efficacy, and locus of control have a significant effect on the financial management behavior of accounting students in Bandung City. It can be concluded that locus of control cannot influence students' financial management behavior without other variables or factors such as the quality of financial learning and financial self-efficacy.

Downloads

References

Amanah, E., Rahadian, D., & Iradianty, A. (2016). Pengaruh Financial Knowledge, Financial Attitude dan External Locus Of Control Terhadap Personal Financial Management Behavior pada Mahasiswa S1 Universitas Telkom. e-Proceeding of Management, 3(2), 1228–1235. Diambil dari https://openlibrarypublications.telkomuniversity.ac.id/index.php/management/article/view/1448

Arifa, J. S. N., & Rediana, S. (2020). Pengaruh Pendidikan Keuangan di Keluarga, Pendapatan, dan Literasi Keuangan Terhadap Financial Management Behavior Melalui Financial Self Efficacy Sebagai Variabel Mediasi. Economic Education Analysis Journal, 9(2), 552–568. Diambil dari https://journal.unnes.ac.id/sju/index.php/eeaj/article/view/39431

Asandimitra, N., & Kautsar, A. (2019). The Influence of Financial Information, Financial Self Efficacy, and Emotional Intelligence to Financial Management Behavior of Female Lecturer. Humanities and Social Sciences Reviews, 7(6), 1112–1124. https://doi.org/10.18510/hssr.2019.76160

Atikah, A., & Kurniawan, R. R. (2020). Pengaruh Literasi Keuangan, Locus of Control, dan Financial Self Efficacy Terhadap Perilaku Manajemen Keuangan (Studi pada PT. Panarub Industry Tangerang) Atik. Jurnal Manajemen Bisnis, 10(2), 284–297.

Ball, R. (1995). No TitleThe Theory of Stock Market Efficiency: Accomplishments and Limitations. Journal of manajerial finance, 35–48.

Bandura, A., & Wessels, S. (1997). Self-efficacy. Diambil dari http://happyheartfamilies.citymax.com/f/Self_Efficacy.pdf

Brandon, D. P., & Smith, C. M. (2009). Prospective Teachers’ Financial Knowledge and Teaching Self-Efficacy. Journal of Family & Consumer Sciences Education, (1), 27.

Danes, S., & Haberman, H. (2007). Teen Financial Knowledge, Self-Efficacy, and Behavior: A Gendered View. Journal of Financial Counseling. Diambil dari https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2228406

Depdiknas. (2003). Undang-Undang No. 20 Tahun 2003 tentang Sistem Pendidikan Nasional. Jakarta: Depdiknas.

Erawati, N., & Susanti. (2017). Pengaruh Literasi Keuangan, Pembelajaran Di Perguruan Tinggi, Dan Pengalaman Bekerja Terhadap Perilaku Keuangan Mahasiswa Fakultas Ekonomi Universitas. Jurnal Pendidikan Akuntansi (JPAK) UNESA, 1–7. Diambil dari https://ejournal.unesa.ac.id/index.php/jpak/article/view/17949

Fatimah, N. (2018). Pengaruh Pembelajaran Akuntansi Keuangan, Literasi Keuangan, dan Pendapatan Terhadap Perilaku Keuangan Mahasiswa Fakultas Ekonomi Universitas Muhammadiyah Gresik. Jurnal Pendidikan Akuntansi (JPAK), 6(1), 48–57.

Forbes, J., & Kara, S. M. (2010). Confidence mediates how investment knowledge influences investing self-efficacy. Journal of Economic Psychology, 31(3), 435–443. https://doi.org/10.1016/j.joep.2010.01.012

Ghozali, I. (2018). Aplikasi Analisis Multivariate Dengan Program IBM SPSS 25, Edisi 9. Semarang: Badan Penerbit UNDIP.

Grable, J. E., Park, J. Y., & Joo, S. H. (2009). Explaining Financial Management Behavior for Koreans Living in the United States. Journal of Consumer Affairs, 43(1), 80–107. https://doi.org/10.1111/J.1745-6606.2008.01128.X

Herawati, N. T. (2015). Kontribusi Pembelajaran di Perguruan Tinggi dan Literasi Keuangan Terhadap Perilaku Keuangan Mahasiswa. Jurnal Pendidikan dan Pengajaran, 48(1–3), 60–70. https://doi.org/10.23887/jppundiksha.v48i1-3.6919

Herawati, N. T., Candiasa, I. M., Yadnyana, I. K., & Suharsono, N. (2018). Pengaruh Kualitas Pembelajaran Keuangan dan Literasi Keuangan Terhadap Financial Self Efficacy Mahasiswa Akuntansi. JPEKA: Jurnal Pendidikan Ekonomi, Manajemen dan Keuangan, 2(2), 115. https://doi.org/10.26740/jpeka.v2n2.p115-128

Ida, I., & Dwinta, C. Y. (2010). Pengaruh Locus Of Control, Financial Knowledge, Income Terhadap Financial Management Behavior. Jurnal Bisnis dan Akuntansi, 12(3), 131–144. https://doi.org/10.34208/JBA.V12I3.202

Kamus Besar Bahasa Indonesia. (2013) (Edisi ke-d). Jakarta: Departemen Pendidikan dan Kebudayaan RI.

Kholilah, N. Al, & Iramani, R. (2013). Studi Financial Behavior pada Mayarakat Surabaya. Journal of Business and Banking, 3(1), 69–80. https://doi.org/10.14414/JBB.V3I1.255

Lim, H., Heckman, S. J., Letkiewicz, J. C., & Montalto, C. P. (2014). Financial Stress, Self-Efficacy, and Financial Help-Seeking Behavior of College Students. Journal of Financial Counseling and Planning, 25(2), 148–160. Diambil dari https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2537579

Maris, S., Baptista, J., & Dewi, A. S. (2021). The Influence of Financial Attitud ,Financial Literacy ,and Locus of Control on Financial Management Behavior, 5(1), 93–98.

Mayasari, M., & Sijabat, Z. (2017). Pengaruh Financial Self-Efficacy terhadap Perilaku Manajemen Keuangan Individu. Journal of Applied Managerial Accounting.

Mien, N. T. N., & Thao, T. P. (2015). Factors Affecting Personal Financial Management Behaviors: Evidence from Vietnam. Economics, Finance and Social Sciences (AP15Vietnam Conference), 47(3), 1–16. https://doi.org/10.1161/01.HYP.0000200705.61571.95

Nofsinger, J. R. (2001). Investment Madness: How Psychology Affects Your Investing and What to Do About It. Prentice Hall.

Novianti, S. (2019). Pengaruh Locus Of Control , Financial Knowledge , Income Terhadap Financial Management Behavior, 28293.

Nurbaeti, I., Mulyati, S., & Sugiharto, B. (2019). The Effect of Financial Literacy and Accounting Literacy to Entrepreneurial Intention Using Theory of Planned Behavior Model in STIE Sutaatmadja Accounting. Jurnal of Accounting for Sustainable Society (JASS), 1(1), 1–19. https://doi.org/https://doi.org/10.35310/jass.v1i01.65

Nurlaila, I. (2020). Faktor-Faktor yang Mempengaruhi Mahasiswa dalam Mengelola Keuangan. Prisma (Platform Riset Mahasiswa Akuntansi), 01(01), 136–144.

Pangeran, P. (2007). Anteseden dan Konsekuensi Emosi Penyesalan pada Disposition Error Investor dalam Keputusan Investasi. Aplikasi dalam Riset Ilmu Ekonomi, Manajemen, dan Akuntansi, 263–297.

Pradiningtyas, T. E., & Lukiastuti, F. (2019). Pengaruh Pengetahuan Keuangan dan Sikap Keuangan terhadap Locus of Control dan Perilaku Pengelolaan Keuangan Mahasiswa Ekonomi. Jurnal Minds: Manajemen Ide dan Inspirasi, 6(1), 96. https://doi.org/10.24252/minds.v6i1.9274

Putri, M. H., & Pamungkas, A. S. (2019). Pengaruh Financial Knowledge, Locus of Control dan Financial Self Efficacy Terhadap Financial Behavior. Jurnal Manajerial dan Kewirausahaan, I(4), 890–889.

Qamar, Muhammad Ali Jibran Khemta, M. A. N., & Jamil, H. (2016). How Knowledge and Financial Self-Efficacy Moderate the Relationship between Money Attitudes and Personal Financial Management Behavior. European Online Journal of Natural and Social Sciences, 5(2), 296–308. Diambil dari www.european-science.com

Rizkiawati, N. L., & Asandimitra, N. (2018). Pengaruh Demografi, Financial Knowledge, Financial Attitude, Locus of Control Dan Financial Self-Efficacy Terhadap Financial Management Behavior Masyarakat Surabaya. Jurnal Ilmu Manajemen (JIM), 6(3), 93–107.

Rotter. (1996). Generalized Expectancies for Internal Versus External Control of Reinforcement. Diambil dari https://psycnet.apa.org/journals/mon/80/1/1/

Selcuk, E. A. (2020). Factors Influencing College Students ’ Financial Behaviors in Turkey : Evidence Factors Influencing College Students ’ Financial Behaviors in Turkey : Evidence from a National Survey. International Journal of Economics and Finance, 7(May 2015), 87–94. https://doi.org/10.5539/ijef.v7n6p87

Shefrin, H. (2000). Beyond Greed and Fear: Understanding Behavioral Finance and Psychology of Investing. Harvard Business School Press.

Susilawati. (2016). 28 Persen Masyarakat Miliki Pengeluaran Lebih Besar dari Pendapatan. Diambil 9 Februari 2022, dari www.republika.co.id/berita/gayahidup/trend/16/0 2/03/o1z6gv384-28-persen-masyarakat-miliki pengeluaran-lebih-besar-dari-pendapatan

Widiawati, M. (2020). Pengaruh Literasi Keuangan, Locus of Control , Financial Self-Efficacy, Dan Love of Money Terhadap Manajemen Keuangan Pribadi. Prisma (Platform Riset Mahasiswa Akuntansi), 1(1), 97–108. Diambil dari https://ojs.stiesa.ac.id/index.php/prisma

Zakaria, R. H., Jaafar, N. I., & Marican, S. (2012). Financial Behavior and Financial Position: a Structural Equation Modelling Approach. Journal of Scientific Research, 11(5), 602–609. Diambil dari https://www.academia.edu/download/31587231/Roza__Noor_Ismawati___Sabitha_(2012).pdf

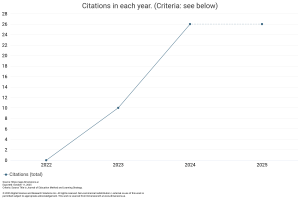

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Nada Dhiya Ulhaq, Elis Mediawati

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Authors who publish with this journal agree to the following terms:

- Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution-ShareAlike that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgement of its initial publication in this journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See The Effect of Open Access).