Features of Tax Regulation of Banks’ Activities and Impact on Financial Activities

DOI:

https://doi.org/10.59653/jbmed.v3i02.1514Keywords:

tax regulation, commercial bank, corporate tax, fiscal policy, financial result, reporting period, tax baseAbstract

This article is devoted to the foreign experience of taxation of commercial banks, and within the framework of the study, the research of foreign and domestic scientists was studied. Taxes paid by banks are always of particular importance in the economic activities of commercial banks. Also, a comparative analysis of the tax policies implemented by foreign countries and the lessons learned from them is presented, and a conclusion is drawn at the end.

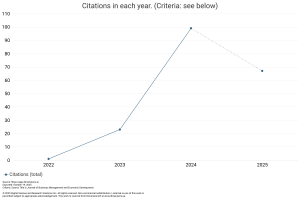

Downloads

References

Ahrorov, Z., Sharin, O., Tuychiev, S., Khudaybergenov, A., Yunusova, S., Raimjanova, M., & Shaislamova, N. (2023). Tax Relations: Current Thinking and New Realities. E3S Web of Conferences, 452. https://doi.org/10.1051/e3sconf/202345205027

Ashurov, S., Abdullah Othman, A. H., Rosman, R. Bin, & Haron, R. Bin. (2020). The determinants of foreign direct investment in Central Asian region: A case study of Tajikistan, Kazakhstan, Kyrgyzstan, Turkmenistan and Uzbekistan (A quantitative analysis using GMM). Russian Journal of Economics, 6(2). https://doi.org/10.32609/J.RUJE.6.48556

EC 2010. Financial sector taxation. Taxation Papers, 25, Brussels: Directorate General Taxation and Customs Union, European Commission.

Elmirzaev S.E. Prospects for the development of corporate tax management in the Republic of Uzbekistan. I.f.n. diss. author's reference submitted for obtaining a scientific degree. - T., 2012. - 9 p.

Ergashev, I. (2021). INCREASING TAX CULTURE AS AN IMPORTANT ELEMENT OF TAX DISCIPLINE. Review of Law Sciences, 5(2). https://doi.org/10.51788/tsul.rols.2021.5.2./mkic1460

Ergashev, I. (2022). ISSUES OF IMPROVEMENT OF LEGAL MECHANISMS FOR DIGITALIZATION OF ACTIVITIES OF THE STATE TAX SERVICE. Review of Law Sciences, 6(1). https://doi.org/10.51788/tsul.rols.2022.6.1./zqja3018

Giyasov, S. A. (2021). INTERNATIONAL PRACTICE OF TAX INCENTIVES FOR INNOVATION AND INVESTMENT ACTIVISMS. Journal of Science and Innovative Development, 4(2). https://doi.org/10.36522/2181-9637-2021-2-3

IMF 2010. A fair and substantial contribution by the financial sector: Final report for the G-20. Technical report. Washington: International Monetary Fund.

Keen, Michael and Krelove, Russell and Norregaard, John. 2017. Policy Forum: The Financial Activities Tax 2017. Canadian Tax Journal/Revue Fiscale Canadienne, 2016, Vol. 64, No. 2, p. 389. Available at SSRN [Electronic source]‒ https://ssrn.com/abstract=2909931.

Keynes J.M. 1936. The General Theory of Employment, Interest Rates and Money. Harcourt Brace & World, New York.

Kusainova, A. (2022). LEGAL REGULATION OF ADMINISTRATIVE LIABILITY FOR INFRACTIONS IN THE FIELD OF TAX ASSESSMENT IN THE REPUBLIC OF KAZAKHSTAN AND IN THE REPUBLIC OF UZBEKISTAN. Review of Law Sciences, 6(1). https://doi.org/10.51788/tsul.rols.2022.6.1./fptg4754

Lipsky John. 2010. Don't Forget Financial Sector Reform. [Electronic source]‒ http://blog-imfdirect.imf.org/2010/01/07/financial-sector-reform.

López-Laborda J. and Peña G. 2018. A NEW METHOD FOR APPLYING VAT TO FINANCIAL SERVICES. National Tax Journal, March 2018, 71 (1), 155–182.

Malakeeva S. Rol nalogovogo planirovaniya na predpriyatiyax malogo biznesa // Predprinimatelstvo. – 2017. - No. 6. – S. 114.Pinskaya, M. R., Shatalov, S. D., & Ponomareva, K. A. (2023). Risk Management at the Informal Economy Cutback (the Example of the Republic of Uzbekistan). Management Sciences, 12(4). https://doi.org/10.26794/2304-022x-2022-12-4-76-88

On the "Uzbekistan - 2030" strategy, dated September 12, 2023, No. 06/23/158/0694; 12/29/2023, No. 06/23/214/0984) https://lex.uz/docs/6600413

Poddar, S., & English, M. 1997. Taxation of financial services under a value-added tax: Applying the cash-flow approach. National Tax Journal, 50(1), 89–111.

PWC 2013a. Financial transaction tax: The impact and arguments. A literature review. 21 November 2013.

Sohib, J. (2023). EFFECTIVENESS OF FORMATION OF REVENUE BASE OF LOCAL BUDGETS. International Journal of Advanced Research, 11(03). https://doi.org/10.21474/ijar01/16546

Zaynalov, D. R., & Ahrorov, Z. O. (2019). Modernization of the Tax Science: Methodology and New Paradigms. International Journal of Multidisciplinary and Current Research, 7(03). https://doi.org/10.14741/ijmcr/v.7.3.11

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Komolov Odiljon Sayfidinovich

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Authors who publish with this journal agree to the following terms:

- Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution-ShareAlike that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgement of its initial publication in this journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See The Effect of Open Access).