Factors Affecting the Integrity of Financial Statements with Company Size as a Moderation Variable

DOI:

https://doi.org/10.59653/jbmed.v2i02.682Keywords:

Audit Quality, Committee, Leverage, Commissioner, Report integrityAbstract

This study aims to examine the effect of audit quality, audit committee, leverage, and independent commissioners on the integrity of financial statements in manufacturing companies listed on the Indonesia Stock Exchange in 2019-2021. This study also examines whether company size can moderate the respective relationship between audit quality, audit committee, leverage, and independent commissioners on the integrity of financial statements. This study used a quantitative approach with a comparative causal type. The population in this study is all manufacturing companies listed on the Indonesia Stock Exchange in 2019-2021. The sampling technique uses purposive sampling. The data used in this study is secondary data accessed through the IDX website. Data analysis uses multiple regression analysis for audit quality hypothesis, audit committee, leverage, and the independent commissioner as well as absolute difference value analysis for audit quality, audit committee, leverage, and independent commissioner on financial statement integrity with company size as a moderation variable. The results of this study show that the quality of audits, audit committees, leverage, and independent commissioners have a positive and significant effect on the integrity of financial statements. The moderation variable is the size of the company able to moderate the relationship between audit quality, audit committee, and leverage on the integrity of financial statements.

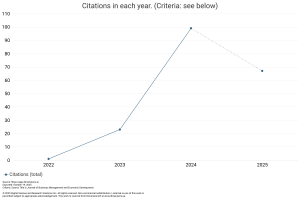

Downloads

References

Adhitya, T. R. (2018). Pengaruh Komisaris Independen, Komite Audit, Kualitas Audit, Dan Leverage Terhadap Integritas Laporan Keuangan Dengan Firm Size Sebagai Variabel Moderasi Pada Perusahaan Pertambangan Yang Terdaftar Di Bursa Efek Indonesia. In Tesis Magister Akuntansi Fakultas Ekonomi dan Bisnis Universitas Sumatera Utara.

Affianti, D., & Supriyati. (2017). The effect of good corporate governance, firm size, leverage, and profitability on accounting conservatism level in the banking industry. The Indonesian Accounting Review, 7(2), 191–202. https://doi.org/10.14414/tiar.v7i2.947

Anggraeni, I. P., Zulpahmi, & Sumardi. (2020). Pengaruh Komite Audit, Komisaris Independen, Leverage, Dan Kualitas Audit Terhadap Integritas Laporan Keuangan Pada Bank Umum Syariah. Jurnal Ilmu Manajemen Dan Akuntansi Terapan (JIMAT), 11(1), 128–138.

Auditya, I., & Wijayanti, P. (2013). Analisis Pengaruh Independensi Auditor, Karakteristik Perusahaan, Kualitas Auditor Dan Pergantian Auditor Terhadap Integritas Laporan Keuangan. Jurnal Akuntansi Indonesia, 2(1), 27–35. https://doi.org/10.30659/jai.2.1.27-35

Danuta, K. S., & Wijaya, M. (2020). Pengaruh Kepemilikan Manajerial, Leverage, dan Kualitas Audit Terhadap Integritas Laporan Keuangan. Majalah Ilmiah Manajemen & Bisnis, 17(1), 1–10.

Dewi, A. S., Rustiarini, N. W., & Dewi, N. P. S. (2021). Pengaruh Kepemilikan Institusional, Dewan Komisaris Independen, Komite Audit Dan Kualitas Audit Terhadap Integritas Laporan Keuangan. Jurnal KARMA (Karya Riset Mahasiswa Akuntansi), 1(4), 1449–1455.

Fahri, Z., Sumarlin, & Jannah, R. (2022). Pengaruh Struktur Modal, Kebijakan Utang, Dan Umur Perusahaan Terhadap Nilai Perusahaan Dengan Ukuran Perusahaan Sebagai Variabel Moderasi. Islamic Accounting and Finance Review, 3(1), 1–17.

Febrilyantri, C. (2020). Pengaruh Intellectual Capital, Size dan Leverage Terhadap Integritas Laporan Keuangan Pada Perusahaan Manufaktur Sektor Food and Beverage Tahun 2015-2018. Riset & Jurnal Akuntansi, 4(1), 267–275. https://doi.org/10.33395/owner.v4i1.226

Febrina, R., & Rabaina, L. S. (2019). Pengaruh Komite Audit Dan Kualitas Audit Terhadap Integritas Laporan Keuangan Pada Perusahaan Manufaktur Yang Terdaftar Di BEI. Jurnal Akuntansi Dan Keuangan, 8(2), 96–106. https://doi.org/.1037//0033-2909.I26.1.78

Gayatri, I. A. S., & Suputra, I. D. G. D. (2013). Pengaruh Corporate Governance, Ukuran Perusahaan, dan Leverage terhadap Integritas Laporan Keuangan. E-Jurnal Akuntansi Universitas Udayana, 5(2), 345–360. https://doi.org/10.35134/jbeupiyptk.v5i3.99

Hardaningsih, P. (2010). Pengaruh Independensi, Corporate Governance, Dan Kualitas Audit Terhadap Integritas Laporan Keuangan. Kajian Akuntansi, 2(1), 61–76. https://journal.ubm.ac.id/index.php/business-applied-management/article/view/1355

Jensen, M. C., & Meckling, W. H. (1976). Theory Of The Firm : Managerial Behavior, Agency Costs, And Ownership Structure. Journal of Financial Economics, 305–360. https://doi.org/10.1177/0018726718812602

Maharani, N. P., & Khristiana, Y. (2022). Determinan Integritas Laporan Keuangan Perusahaan Manufaktur. Jurnal Buana Akuntansi, 7(1), 83–96. https://doi.org/10.36805/akuntansi.v7i1.2176

Nurdiniah, D., & Pradika, E. (2017). Effect of Good Corporate Governance, KAP Reputation, Its Size and Leverage on Integrity of Financial Statements. International Journal of Economics and Financial Issues, 7(4), 174–181. https://www.proquest.com/docview/1984683726/75B76916F372468DPQ/3?accountid=31731

Nurjannah, L., & Pratomo, D. (2014). Pengaruh Komite Audit , Komisaris Independen Dan Kualitas Audit Terhadap integritas Laporan Keuangan ( Pada Perusahaan Manufaktur Yang Terdaftar Di Bursa Efek Indonesia Tahun 2012). Jurnal Bisnis Dan Manajemen, 1(3), 99–105. https://id.scribd.com/document/268343040

Nuryaman. (2009). Pengaruh Konsentrasi Kepemilikan, Ukuran Perusahaan, Dan Mekanisme Corporate Governance Terhadap Pengungkapan Sukarela. Jurnal Akuntansi Dan Keuangan Indonesia, 6(1), 89–116. https://doi.org/10.21002/jaki.2009.05

Puspita, M. ayu prilla winda, & Utama, I. made karya. (2016). Fee Audit Sebagai Pemoderasi Pengaruh Kualitas Audit Terhadap Integritas Laporan Keuangan. E-Jurnal Akuntansi Universitas Udayana, 16(3), 1829–1856.

Putra, O. E., Aristi, M. D., & Azmi, Z. (2022). Pengaruh Corporate Governance, Ukuran Perusahaan, Kualitas Audit Terhadap Integritas Laporan Keuangan. SINTAMA: Jurnal Sistem Informasi, Akuntansi Dan Manajemen, 2(1), 143–155.

Santoso, S. D., & Andarsari, P. R. (2022). Pengaruh Kepemilikan Manajerial, Ukuran Perusahaan dan Kualitas Audit Terhadap Integritas Laporan Keuangan. Riset & Jurnal Akuntansi, 6(1), 690–700. https://doi.org/10.33395/owner.v6i1.585

Savero, D. O. (2017). Pengaruh Komisaris Independen, Komite Audit, Kepemilikan Instutisional Dan Kepemilikan Manajerial Terhadap Integritas Laporan Keuangan. JOM Fekon, 4(1), 75–89.

Silalahi, T. (2021). Pengaruh Kualitas Audit, Audit Tenure dan Ukuran Perusahaaan Terhadap Integritas Laporan Keuangan (Studi Empiris Pada Perusahaan BUMN Yang Terdaftar Di Bursa Efek Indonesia Tahun 2016-2019). Jurnal Ilmiah Mahasiswa FEB Universitas Brawijaya, 10(1), 1–14.

Yulinda, N. (2016). Pengaruh Komisaris Independen, Komite Audit, Leverage, Pergantian Auditor, dan Spesialisasi Industri Auditor Terhadap Integritas Laporan Keuangan. Jurnal Online Mahasiswa Fakultas Ekonomi Universitas Riau, 3(1), 419–433.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Nurhidayah Ainun Amalia, Andi Wawo, Raodahtul Jannah

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Authors who publish with this journal agree to the following terms:

- Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution-ShareAlike that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgement of its initial publication in this journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See The Effect of Open Access).