Fair Metaphors in Mudharabah Contracts in the Sharia Finance Sector

DOI:

https://doi.org/10.59653/jmisc.v3i03.1942Keywords:

Fairness, Islamic Finance, Financial Literacy, Mudharabah, TransparencyAbstract

This research focuses on the application of the principle of justice in mudharabah contracts in the Islamic financial sector, using the metaphor of “justice as a balanced scale” to describe the proportional relationship between the capital owner (shahibul maal) and the business manager (mudharib). The purpose of this study is to analyze the elements of justice in mudharabah practice and its impact on social relations and economic empowerment. The method used is a literature study with a normative and socio-empirical approach, through a review of relevant literature and justice theory. The results show that although normatively mudharabah upholds justice, its practice still faces challenges in the form of information inequality, low financial literacy, and weak contract transparency. This research implies the importance of fair and participatory contract design, as well as strengthening financial literacy for micro business actors to support an inclusive, ethical and sustainable Islamic financial system.

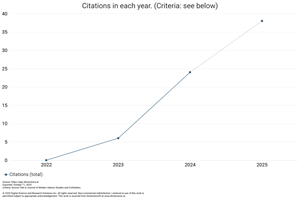

Downloads

References

Ahmad, F. R. (2020). Critical Analysis of Low Profit-Sharing Financing at BMT in Jepara. TAWAZUN: Journal of Sharia Economic Law, 3(2), 141–154.

Ahmad, S., & Hassan, R. (2018). Financial literacy and management training for Islamic microfinance: Evidence from micro-entrepreneurs in Malaysia. Journal of Islamic Accounting and Business Research, 9(2), 155–172. https://doi.org/https://doi.org/10.1108/JIABR-07-2016-0083

Al-Bukhari, M. I. (2003). Shahih al-Bukhari (Terj. Muhammad Nashiruddin al-Albani). Pustaka Azzam.

Al-Shammari, M. (2019). Contract Clarity and Trust in Islamic Finance: A Study of Mudharabah Agreements. Journal of Islamic Banking and Finance, 8(1), 15–30.

Alsagoff, S. H., & Surono, A. O. (2015). Empowering the Poor Through Islamic Microfinance. Isdb.Org. https://www.isdb.org/sites/default/files/media/documents/2022-05/Empowering-the-Poor-through-Islamic-Microfinance-Experience-of-the-Bank-of-Khartoum-Sudan-in-Value-Chain-Project-Financing.pdf

Azzam, M. (2020). Inequality in mudharabah contract practices: A field study of micro-businesses. Journal of Islamic Economics, 11(2), 145–162.

Chapra, M. U. (1992). Islam and the economic challenge (Issue 17). International Institute of Islamic Thought (IIIT).

Dawud, A. (2008). Sunan Abu Dawud (Jilid 3, No. Hadis 3594) (D. oleh N. Al-Khattab (ed.)). Riyadh: Darussalam.

Ministry of Religious Affairs, R. I. (1994). The Qur'an and Its Translation: Juz 1-30. Jakarta: PT. Kumudasmoro Grafindo.

Halim, S. (2020). Effect Of Financing In Sharia Business Units On Profitability And Financing Risk Management. Journal of Islamic Economics and Social Science (JIESS), 1(1), 11. https://doi.org/10.22441/jiess.2020.v1i1.002

Hassan, M. K., & Ali, A. (2025). Islamic microfinance and poverty alleviation: Evidence from the field. In Islamic Finance and Economic Development, 3(1), 68–79.

Islam, R., & Ahmad, R. (2022). Incorporation of mudarabah, musharakah and musharakah mutanaqisah with microfinance: A sustainable livelihood approach to poverty alleviation. Journal of Economic Cooperation and Development, 43(3), 41–64.

Ismail, A. G., & Latiff, R. A. (2020). Justice in Islamic finance: A value-based framework. IIUM Press.

KHALİFAH, M. H., ASLAN, H., & ABDULLAH, A. (2024). Challenges in the Implementation of Mudharabah Financing in the Islamic Banking Industry. Equinox Journal of Economics Business and Political Studies, 11(1), 1–23. https://doi.org/10.48064/equinox.1341793

Khan, M. F. (2013). Islamic finance: Theory and practice. International Institute of Islamic Thought (IIIT).

Nawawi, M. K., & Pertiwi. (2024). MSME economic empowerment through community-based Sharia microfinance program in DT Peduli Bogor. The Economic Review of Policy, 4(1), 20–35.

Njonge, T. (2023). Influence of Psychological Well-Being and School Factors on Delinquency , During the Covid-19 Period Among Secondary School Students in Selected Schools in Nakuru County : Kenya. VII(2454), 1175–1189. https://doi.org/10.47772/IJRISS

Nur, A. (2019). T Transparency and fairness in the implementation of mudharabah contracts in Islamic financial institutions. Journal of Islamic Economics 11(1), 45–56. https://doi.org/https://doi.org/10.15408/jes.v11i1.12345

Rahman, A. (2010). Islamic microfinance: An ethical alternative to poverty alleviation. Humanomics, 26(1), 17–25.

Rahman, F. (2021). Financial literacy and access to Islamic financing for MSMEs. Journal of Islamic Finance, 7(2), 114–129. https://doi.org/https://doi.org/10.21098/jki.v7i2.763

Renaldi, M., Putra, A., Shadiqul, M., & Af, F. (2024). The Role of Mudharabah Contracts in Micro, Small, and Medium Enterprise Financing in Samarinda City. 3(01), 1–6. https://doi.org/10.58812/sek.v3i01

Roslan, M. F., Bamahriz, O., Muneeza, A., Chu, J., Mustapha, Z., & Ahmad, M. Z. (2020). Application of Tawarruq in Islamic Banking in Malaysia: Towards Smart Tawarruq. International Journal of Management and Applied Research, 7(2), 104–119. https://doi.org/10.18646/2056.72.20-008

Ryandono, M. N. H., Kusuma, K. A., & Prasetyo, A. (2021). The Foundation of a Fair Mudarabah Profit Sharing Ratio: A Case Study of Islamic Banks in Indonesia. Journal of Asian Finance, Economics and Business, 8(4), 0329–0337. https://doi.org/10.13106/jafeb.2021.vol8.no4.0329

Saeed, A. (1996). Islamic banking and interest: A study of the prohibition of riba and its contemporary interpretation (Vol. 2). Brill.

Salama, S. C. U., & Azizah, N. N. (2023). How Baitul Maal Wa Tamwil Solve Bad Financing During The Pandemic? East Java Economic Journal, 7(1), 136–152. https://doi.org/10.53572/ejavec.v7i1.101

Saleem, A., Daragmeh, A., Zahid, R. M. A., & Sági, J. (2024). Financial intermediation through risk sharing vs non-risk sharing contracts, role of credit risk, and sustainable production: evidence from leading countries in Islamic finance. In Environment, Development and Sustainability (Vol. 26, Issue 5). Springer Netherlands. https://doi.org/10.1007/s10668-023-03298-7

Sarono, A. (2019). Analysis of Mudharabah Financing Problems and Their Solutions. Diponegoro Private Law Review, 4(1), 401–409. https://ejournal2.undip.ac.id/index.php/dplr/article/view/5024/2649

Sen, A. (1999). Development as Freedom Oxford University Press Shaw TM & Heard. The Politics of Africa: Dependence and Development.

Setiawan, N. (2016). Implementation of Profit and Loss Sharing System and Sharia Financial Accounting Treatment in Muḍarabah and Musyarakah Financing in Sharia Banking in Indonesia. UIN Sunan Kalijaga Yogyakarta.

Sheikh, R., Ayaz, M., & Siddique, M. A. (2023). Sharī‘ah Governance and Sharī‘ah Non-Compliance Risk Management: A Maqāsid Sharī‘ah Based Appraisal. Journal of Islamic Thought and Civilization (JITC), 13(1), 270–291. https://doi.org/10.32350/jitc

Sholihah, U. (2021). Islamic Bussiness Concept In Facing Moral Hazard Of Mudharabah Financing In Indonesia Islamic Banking (Perspective: Asymetric Information Theory). Journal of Strategic and Global Studies, 4(1). https://doi.org/10.7454/jsgs.v4i1.1036

Sori, Z. M., Hussin, S., & Hamid, B. A. (2025). Developing an ESG Disclosure Index for Islamic Financial Institutions: Enhancing Transparency and Accountability Zulkarnain Muhamad Sori, Syaryanti Hussin and Baharom Abd Hamid INCEIF University, USIM. Inceif, 1, 1–18. https://ssrn.com/abstract=5115926

Supriatna, S., Helmi, I., & Nurrohman, N. (2020). Mudharabah Scheme Within the Islamic Banking: Profit Sharing and Associated Problems in It. Kodifikasia, 14(2), 235–262. https://doi.org/10.21154/kodifikasia.v14i2.2121

Usanti, T. P., Shomad, A., & Kurniawan, A. (2014). the Principle of Justice in Transactions Based on Profit and Loss Sharing in Sharia Banks. Mimbar Hukum - Fakultas Hukum Universitas Gadjah Mada, 26(2), 308. https://doi.org/10.22146/jmh.16050

Usmani, M. M. T. (2021). An introduction to Islamic finance (Vol. 20). Brill.

Wahab, N. A., Bin-Nashwan, S. A., Chik, M. N., & Hussin, M. Y. M. (2023). Islamic Social Finance Initiatives: an Insight Into Bank Islam Malaysia Berhad’S Innovative Bangkit Microfinance Product. ISRA International Journal of Islamic Finance, 15(1), 22–35. https://doi.org/10.55188/ijif.v15i1.483

Wahyuni, S., & Rahman, A. (2020). Social cohesion and trust in mudharabah partnership: A case study of local communities. Journal of Islamic Economics, Banking and Finance, 16(3), 45–60. https://doi.org/https://doi.org/10.12816/0047321

Wanke, P., Hassan, M. K., Azad, M. A. K., Rahman, M. A., & Akther, N. (2022). Application of a distributed verification in Islamic microfinance institutions: a sustainable model. Financial Innovation, 8(1). https://doi.org/10.1186/s40854-022-00384-z

Widya, W., Vidiati, C., & Dpp, G. N. (2024). Inovasi dan Pengembangan Fintech Syariah sebagai Solusi Keuangan Modern yang Berlandaskan Prinsip Syariah. Co-Value Jurnal Ekonomi Koperasi Dan Kewirausahaan, 15(7).

Yasin, M. Z. (2020). The role of microfinance in poverty alleviations: Case study Indonesia. International Journal of Islamic Economics and Finance Studies, 6(2), 23–39.

Zaki Ahmad, Faathih Zahir, Ahmed Mohamud Usman, Aishath Muneeza, & Zakariya Mustapha. (2020). An Exploratory Study On The Possibility Of Replacing Tawarruq Based Islamic Banking Products Using Other Alternatives. International Journal of Management and Applied Research, 7(2), 143–159.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Dedi Mardianto, Ina Safitri

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Authors who publish with this journal agree to the following terms:

- Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution-ShareAlike that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgement of its initial publication in this journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See The Effect of Open Access).