Tax Policy Solutions for Economic Growth in Ho Chi Minh City

DOI:

https://doi.org/10.59653/jbmed.v3i02.1497Keywords:

tax policy, Economic growth, Ho Chi Minh City, Vietnam, Tax Incentive, Policy Change, Research on TaxationAbstract

This research examines tax policy strategies to enhance sustainable economic development in Ho Chi Minh City, Vietnam. Using a qualitative research approach, the study identifies inefficiencies in tax collection, the impact of tax incentives, and issues related to governance and compliance. Key findings highlight the need to align local tax policies with national economic strategies, increase transparency, and optimize tax incentives to foster economic stability. Recommendations focus on enhancing digital tax systems, improving public tax awareness, and reforming bureaucratic processes to establish a more efficient and equitable tax framework.

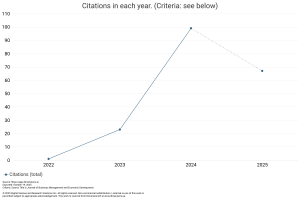

Downloads

References

Bui, M. T., Ngo, H. T., Nguyen, G. T. C., & Duong, H. N. (2024). Tax revenue in ASEAN: Impact factors and policy recommendations. Global Business & Finance Review (GBFR), 29(6), 158-169. https://hdl.handle.net/10419/306020

Dang, V. C., & Nguyen, Q. K. (2021). Determinants of FDI attractiveness: Evidence from ASEAN-7 countries. Cogent Social Sciences, 7(1), 2004676. https://doi.org/10.1080/23311886.2021.2004676

Do, T. N., Burke, P. J., Baldwin, K. G., & Nguyen, C. T. (2020). Underlying drivers and barriers for solar photovoltaics diffusion: The case of Vietnam. Energy Policy, 144, 111561. https://doi.org/10.1016/j.enpol.2020.111561

Gale, W. G., Hoopes, J. L., & Pomerleau, K. (2024). Sweeping Changes and an Uncertain Legacy: The Tax Cuts and Jobs Act of 2017. Journal of Economic Perspectives, 38(3), 3-32. Sweeping Changes and an Uncertain Legacy: The Tax Cuts and Jobs Act of 2017 - American Economic Association

Ha, N. T. T., Giang, N. H., Dung, N. A., & Thuy, N. T. D. (2024). Financial Policies for Small and Medium Enterprises (SMEs) in Vietnam Nowadays. Educational Administration: Theory and Practice, 30(4), 2369-2378. https://doi.org/10.53555/kuey.v30i4.1859

Ha, V. T. C. (2021). The effects of foreign direct investment on domestic firms: The case of Vietnam (Doctoral dissertation, The University of Waikato). https://hdl.handle.net/10289/14062

Hang, N. P. T., & Nhan, T. T. (2022). Factors affecting value added tax compliance behavior of enterprise: A study of the Tax Office of Binh Tan district, Ho Chi Minh city. Tạp chí Khoa học và Công nghệ-Đại học Đà Nẵng, 84-89. Factors affecting value added tax compliance behavior of enterprise: A study of the Tax Office of Binh Tan district, Ho Chi Minh city | Tạp chí Khoa học và Công nghệ - Đại học Đà Nẵng

Lazaar, N. (2022). The Process of Approaching the Taxation of the Exploitation of Personal Data. International Journal of Accounting, Finance, Auditing, Management and Economics, 3(6-1), 324-350. https://doi.org/10.5281/zenodo.7419548

López-Morales, E., Herrera, N., & Garretón, M. (2024). Neoliberal urban segregation and property tax: A critical view of Santiago, Chile. Environment and Planning A: Economy and Space, 56(6), 1820-1840. https://doi.org/10.1177/0308518X241276871

Nguyen, H. T. T., NGUYEN, C. V., & NGUYEN, C. V. (2020). The effect of economic growth and urbanization on poverty reduction in Vietnam. The Journal of Asian Finance, Economics and Business, 7(7), 229-239. JAKO202020952022470.pdf

Nguyen, L. U. (2019). The construction of accountant identity in a transitioning economy: the case of Vietnam. Accounting & Finance, 59(3), 1709-1740. https://doi.org/10.1111/acfi.12470

Nguyen, T. D., & Dinh, H. T. (2024). Economic structural transformation: The Vietnamese case for developing nations in a globalization context. Journal of Infrastructure, Policy and Development, 8(4), 4261. Economic structural transformation: The Vietnamese case for developing nations in a globalization context | Nguyen | Journal of Infrastructure, Policy and Development

Nguyen, T. M. P. (2023). Determinants influencing the satisfaction of firms towards electronic tax (eTax) service in an emerging market. Corporate Governance and Organizational Behavior Review, 7(3), 118-130. https://doi.org/10.22495/cgobrv7i3p10

Nguyen-Anh, T., Hoang-Duc, C., Nguyen-Thi-Thuy, L., Vu-Tien, V., Nguyen-Dinh, U., & To-The, N. (2022). Do intangible assets stimulate firm performance? Empirical evidence from Vietnamese agriculture, forestry and fishery small-and medium-sized enterprises. Journal of Innovation & Knowledge, 7(3), 100194. https://doi.org/10.1016/j.jik.2022.100194

Spataro, L., & Crescioli, T. (2024). How much capital should be taxed? A review of the quantitative and empirical literature. Journal of Economic Surveys, 38(4), 1399-1436. https://doi.org/10.1111/joes.12586

Thai, H. M. H., Khuat, H. T., & Kim, H. M. (2021). Urban form, the use of ICT and smart cities in Vietnam. In Smart cities for technological and social innovation (pp. 137-156). Academic Press. https://doi.org/10.1016/B978-0-12-818886-6.00008-3

Thi, P., & Thoan, P. (2023). Economic Development with Environmental Protection in Ho Chi Minh City, Vietnam: Situations and Problems. Journal of Law and Sustainable Development, 11(5), e781-e781. https://doi.org/10.55908/sdgs.v11i5.781

Trien, N. T. (2022). Equity in Tax Law: Vietnam Case Study. Administrative and Environmental Law Review, 3(2), 101-110. https://doi.org/10.25041/aelr.v3i2.2662

Van Trong, D. (2022). The Leading Role of State Economy in a Socialist-Oriented Market Economy in Vietnam. International Journal of Advanced Research in Economics and Finance, 4(1), 80-89. https://doi.org/10.55057/ijaref.2022.4.1.9

Vo, D. H., Nguyen, H. M., Vo, T. M., & McAleer, M. (2020). Information sharing, bank penetration and tax evasion in emerging markets. Risks, 8(2), 38. https://doi.org/10.3390/risks8020038

Wang, Z. (2023). Convergence as Adaptivity: Understanding Policymaking in an Era of Globalization. State University of New York Press.

Yan, E., Feng, Q., & Ng, Y. K. (2021). Do we need ramsey taxation? Our existing taxes are largely corrective. Economic Modelling, 94, 526-538. https://doi.org/10.1016/j.econmod.2020.03.031

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Luong Minh Duc

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Authors who publish with this journal agree to the following terms:

- Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution-ShareAlike that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgement of its initial publication in this journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See The Effect of Open Access).