Influence of Easy, Speed and Security of Transactions on Decision to Use BRI EDC Machine in Indonesia

DOI:

https://doi.org/10.59653/jbmed.v2i03.978Keywords:

Ease of Use, Speed of Transactions, Security of Transactions, Usage Decisions, EDC Merchant Machine BRIAbstract

Technological developments that have occurred to date have led to the birth of payment system innovation in economic transactions. The payment system is no longer done in cash but non-cash. Types of non-cash payments in Indonesia such as phone banking, e-wallet and e-money, internet banking, and payment by credit card and debit card or / ATM card. One method of using a debit card is an EDC machine. Many banks have made EDC machine innovations, one of which is a merchant-specific EDC machine by BRI. The purpose of this study is to determine the influence of the variables of ease of use, transaction speed, and transaction security on the decision to use the EDC machine of BRI merchants in Indonesia. The data used in this study are primary data obtained from the results of respondents' answers collected with the help of questionnaires. The number of samples in this study was 140 respondents. The sample collection method uses purposive sampling, which is a technique used to determine samples with criteria determined by the researcher. The analytical methods used in this study are validity test, reliability test, partial test (T-test), simultaneous test (F test), and coefficient of determination (R20. Then the analysis stage uses multiple linear regression analysis with the help of the SPSS 26 application. The results of this study show that ease of use and security have a significant effect on usage decisions but transaction speed does not have a significant effect on usage decisions.

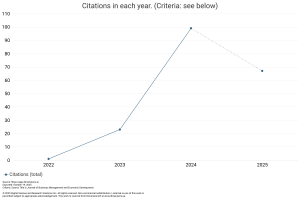

Downloads

References

Arrely Syamsa Kartika, & Dewa Gde Rudy. (2022). Perlindungan Konsumen dan Perusahaan Financial Technology di Indonesia: Inovasi dan Tantangan Otoritas Jasa Keuangan. Jurnal Kertha Wicara, 11(7), 1426–1441.

Bank Indonesia. (2014). Bank Sentral Republik Indonesia. Bank Indonesia, p. 1. Received from https://www.bi.go.id/id/ruang-media/siaran-pers/pages/sp_165814.aspx

Chen, H.H., & Chen, S. C. (2009). The empirical study of automotive telematics acceptance in Taiwan: Comparing three technology acceptance models. International Journal of Mobile Communications, 7(1), 50-65. https://doi.org/10.1504/IJMC.2009.021672

Chen, L., & Nath, R. (2008). Determinants of Mobile Payments: An Empirical Analysis. Journal of International Technology and Information Management, 17(1). https://doi.org/10.58729/1941-6679.1105

Chainmaa, B., Najib, E., & Rachid, H. (2021). E-banking Overview: Concepts, Challenges and Solutions. Wireless Personal Communications, 117(2), 1059- 1078

Das, S.A., & Ravi, N.(2021). A Study on the Impact of E-Banking Service Quality on Consumer Satisfaction . Satisfaction Journal of Economics, Finance and Management, 48-56

Guderian, C. C., Bican, P.M., Riar, F.J., & & Chattopadhyay, S. (2021). Inovation management in crisis: patent analytics as a respons to the COVID-19 pandemic. R&D Management, 51(2),223-239.

Herry Achmad Buchory & Djaslim Saladin. (2010) Manajemen Pemasaran Bandung : Linda Karya.

Javadikasgari, H., Soltesz, E. G., & Gillinov, A. M. (2018). Surgery for Atrial Fibrillation. In Atlas of Cardiac Surgical Techniques (pp. 479–488). https://doi.org/10.1016/B978-0-323-46294-5.00028-5

Khan, M.A., Nabi, M.K., Khojah, M.,& Tahir, M.(2021). Students perception towards e-learning during COVID -19 pandemic in India: An Emprical Study. Sustainability, 13(1), 57.

Kotler & Keller. (2016). Manajemen Pemasaran. Jakarta : Erlangga.

Lau, S., & Pradana, M. N. R. (2021). Pengaruh keamanan, kecepatan transaksi dan kenyamanan terhadap penggunaan mobile payment. KINERJA: Jurnal Ekonomi Dan Manajemen, 18(2), 288–295. http://journal.feb.unmul.ac.id/index.php/KINERJA/article/view/7938

Li, X. (2022). Bank Competition and Entrepreneurial Gaps: Evidence from Bank Deregulation. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3985645

Mulyaningtyas, D., & Ihsan, S. L. (2023). Pengaruh Daya Tarik Promosi, Persepsi Kemudahan Dan Persepsi Keamanan Terhadap Keputusan Penggunaan Ewallet Pada Generasi Y Dengan E-Trust Sebagai Variabel Intervening. 9(2), 69–76.

Prastiawan, D. I., Aisjah, S., & Rofiaty, R. (2021). The Effect of Perceived Usefulness, Perceived Ease of Use, and Social Influence on the Use of Mobile Banking through the Mediation of Attitude Toward Use. Asia Pacific Management and Business Application, 009(03), 243–260. https://doi.org/10.21776/ub.apmba.2021.009.03.4

Santi, S. C. (2016). Pengaruh Kepercayaan, Kemudahan Penggunaan Dan Keamanan Yang Dirasakan Terhadap Keputusan Penggunaan Flazz Bca Di Kota Surabaya. http://eprints.perbanas.ac.id/2433/

Shankar, A., & Jebarajakirthy, C. (2019). The influence of e-banking service quality on customer loyalty: A moderated mediation approach. International Journal of Bank Marketing, 37(5), 1119–1142. https://doi.org/10.1108/IJBM-03-2018-0063

Sudirjo, F., Syamsuri, H., Mardiah, A., Widarman, A., & Novita, Y. (2023). Analysis of The Influence of Customer Perceived Benefit, Ease of Use and Sales Promotion on The Decision to Use Digital Wallets for Shopeepay Customers. Jurnal Sistim Informasi Dan Teknologi, 5(3), 63–68. https://doi.org/10.60083/jsisfotek.v5i3.304

Sugiyanto, S., Mulyana, M., & Ramadhan, M. V. (2021). Pengaruh Keamanan, Kemudahan Transaksi dan Persepsi Resiko terhadap Minat Beli. Jurnal Informatika Kesatuan, 1(1), 23–30. https://doi.org/10.37641/jikes.v1i1.404

Sugiyono. (2006). Metode Penelitian Kuantitatif Kualitatif dan R&D. Bandung: CV. Alfabeta.

Sugiyono. (2008). Metode Penelitian Bisnis. Bandung: CV. Alfabeta

USMAN, R. (2017). Karakteristik Uang Elektronik Dalam Sistem Pembayaran. Yuridika, 32(1), 134. https://doi.org/10.20473/ydk.v32i1.4431

Yam, J. H., & Taufik, R. (2021). Hipotesis Penelitian Kuantitatif. Perspektif : Jurnal Ilmu Administrasi, 3(2), 96–102. https://doi.org/10.33592/perspektif.v3i2.1540

Zahara, R., Nasution, A. W., & Asmalidar. (2021). Pengaruh Kemudahan dan Keamanan terhadap Keputusan Menggunakan E-Money pada Mahasiswa Politeknik Negeri Medan. Polimedia, 24(1), 39–54.

Downloads

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Rangga Aldiansyah Saputra, Yuniarti Fihartini, Nurul Husna

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Authors who publish with this journal agree to the following terms:

- Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution-ShareAlike that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgement of its initial publication in this journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See The Effect of Open Access).