The Effect of Profitability, Financial Leverage, Firm Size, Dividend Policy, and Stock Value on Income Smoothing in Food and Beverages Companies Listed on Indonesia Stock Exchange in 2020-2022

DOI:

https://doi.org/10.59653/ijmars.v2i02.731Keywords:

Profitability, Financial Leverage, Firm Size, Dividend Policy, Stock Value, Income SmoothingAbstract

Income smoothing is the intentional normalizing of profits to a specified level or trend. Smoothing is an attempt by the company's management to lessen anomalous variations in profitability, to the extent permitted by solid accounting and management standards. This study aims to explore the effects of many factors, including stock value, dividend policy, firm size, profitability, and financial leverage, on income smoothing approaches. The population of the study consisted of the 84 food and beverage companies that were listed on IDX between 2020 and 2022. The sampling process provides 20 companies for a three-year observation period using a purposive sample method. Logistic regression analysis is used in the data analysis process using the SPSS 26 program. The study's findings indicate that income smoothing is influenced by all variables at the same time. Variable dividend policies significantly have effect on income smoothing, partially. However, there is no effect between the factors of stock value, company size, profitability, or leverage.

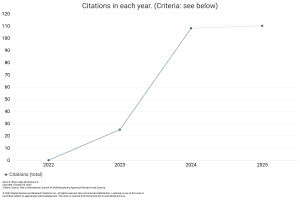

Downloads

References

Belkaoui, & Riahi, A. (2012). Accounting Theory (Buku 2) (5 ed.). Penerbit Salemba Empat.

Bobby, B., Firmansyah, A., Herman, H., & Trisnawati, E. (2022). Kebijakan Utang, Kebijakan Dividen Dan Income Smoothing: Peran Moderasi Ukuran Perusahaan. Jurnal Pajak dan Keuangan Negara (PKN), 4(15), 357–367. https://doi.org/10.31092/jpkn.v4i1s.1831

Fitriani, A. (2018). Pengaruh Profitabilitas, Ukuran Perusahaan, dan Financial Leverage terhadap Praktik Perataan Laba (Income Smoothing) pada Perusahaan Farmasi yang Terdaftar di Bursa Efek Indonesia Periode 2011-2015. Jurnal Samudra Ekonomi dan Bisnis, 9(1), 50–59. https://doi.org/10.33059/jseb.v9i1.461

Hanafi, M. M., & Halim, A. (2016). Analisis Laporan Keuangan (5 ed.). UPP STIM YKPN Yogyakarta.

Jensen, M. C., & Meckling, W. H. (1976). Theory Of The Firm: Managerial Behavior, Agency Costs And Ownership Structure. Journal of Financial Economics 3, 3(4), 305–360. https://doi.org/https://doi.org/10.1016/0304-405X(76)90026-X

Novius, A. (2023). Determinan Faktor yang Mempengaruhi Perataan Laba ( Studi pada Perusahaan Sektor Teknologi yang terdaftar di Bursa Efek Indonesia ). JAAMTER (Jurnal Audit, Akuntansi, Manajemen Terintegrasi), 1(2), 130–141.

Oktoriza, L. A. (2018). Pengaruh Leverage, Profitabilitas, Ukuran Perusahaan, Nilai Perusahaan, Aktivitas Komite Audit Dan Kepemilikan Manajerial Terhadap Praktik Perataan Laba. Stability: Journal of Management and Business, 1(2), 188–203. https://doi.org/10.26877/sta.v1i2.3227

Pradnyandari, A. A. I. R., & Astika, I. B. P. (2019). Pengaruh Ukuran Perusahaan, Nilai Saham, Financial Leverage, Profitabilitas Pada Tindakan Perataan Laba di Sektor Manufaktur. E-Jurnal Akuntansi Universitas Udayana, 27(1), 149–172. https://doi.org/10.24843/eja.2019.v27.i01.p06

Rudianto. (2019). Pengantar Akuntansi Konsep & Teknik Penyusunan Laporan Keuangan. Penerbit Erlangga.

Samsul, M. (2006). Pasar Modal & Manajemen Portofolio. Penerbit Erlangga.

Sartono, A. (2005). Manajemen Keuangan Teori dan Aplikasi (4 ed.). BPFE-YOGYAKARTA.

Scott, W. R. (2003). Willian R Scott - Financial Accounting Theory-Prentice Hall (2003) (3 ed.). Pearson Education.

Setyani, A. Y., & Wibowo, E. A. (2019). Pengaruh Financial Leverage, Company Size, dan Profitabilitas terhadap Praktik Perataan Laba pada Perusahaan Manufaktur yang Terdaftar di Bursa Efek Indonesia. Research Fair Unisri, 3(1), 76–91.

Soly, N., & Novia, W. (2017). Faktor-Faktor Yang Mempengaruhi Kualitas Laba Pada Perusahaan Manufaktur. Jurnal Bisnis dan Akuntansi, 19(2), 47–55. https://doi.org/10.34208/jba.v19i2.273

Spence, M. (1973). JOB MARKET SIGNALING. The Quarterly Journal of Economics, 87(3), 355–374. https://www.jstor.org/stable/1882010

Suwito, E., & Herawaty, A. (2005). Analisis Pengaruh Karakteristik Perusahaan Terhadap Tindakan Perataan Laba Yang Dilakukan Oleh Perusahaan Yang Terdaftar Di Bursa Efek Jakarta. In SNA VIII Solo. https://123dok.com/document/yee033ry-analisis-pengaruh-karakteristik-perusahaan-tindakan-dilakukan-perusahaan-terdaftar.html

Widiasmara, A., Aviyanti, R. D., & Krisdiyana, A. (2022). Analisis Praktik Income Smoothing Pada Perusahaan Pertambangan Di Indonesia. JAK (Jurnal Akuntansi) Kajian Ilmiah Akuntansi, 9(1), 61–71. https://doi.org/10.30656/jak.v9i1.3786

Yusuf, A. muri. (2019). Metodologi Penelitian Kuantitatif, Kualitatif dan Penelitian Gabungan (5 ed.). Prenadamedia Group.

Downloads

Published

How to Cite

Issue

Section

Categories

License

Copyright (c) 2024 Rodisna Marselin Sitompul, Muhammad Gowon, Salman Jumaili

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Authors who publish with this journal agree to the following terms:

- Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution-ShareAlike that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgement of its initial publication in this journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See The Effect of Open Access).