Impact of Financial Literacy and Interest in Saving on Consumptive Behavior

Case Study of Students at SMK 1 Kotamobagu

DOI:

https://doi.org/10.59653/ijmars.v3i02.1590Keywords:

Financial Literacy, Interest in Saving, Consumptive BehaviorAbstract

This study aims to determine the impact of financial literacy and interest in saving on the consumer behavior of students at SMKN Kotamobagu. Consumer behavior among adolescents is increasing with easy access to technology and information, so adequate financial understanding and motivation to save from an early age are needed. The research method used is quantitative with a survey approach. Data collection techniques were carried out by distributing questionnaires to 63 students selected as samples using purposive sampling techniques. Data were analyzed using multiple linear regression to determine the effect of financial literacy variables and interest in saving on consumer behavior. The results of the analysis show that both financial literacy and interest in saving simultaneously have a significant effect on student consumer behavior. Partially, financial literacy has a significant negative effect on consumer behavior, which means that the higher the level of financial literacy, the lower the level of student consumption. Interest in saving also has a significant negative effect, indicating that students with high interest in saving tend to control consumer urges better. These findings emphasize the importance of strengthening financial literacy education and habituation of saving among students as a preventive measure against unhealthy consumption patterns.

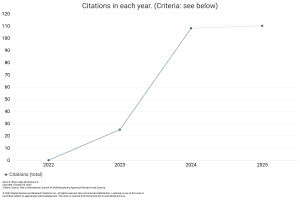

Downloads

References

Andriani, D. (2021). Pengaruh Minat Menabung terhadap Perilaku Konsumtif Siswa SMA di Jakarta Selatan. Jurnal Pendidikan Ekonomi, 13(2), 112–120.

Asni, A., Wangi, N. M., & Aini, N. (2021). The effect of self management on consumptive behavior in students. Jurnal Konseling Dan Pendidikan, 9(1). https://doi.org/10.29210/152100

Asisi, I., & Purwantoro. (2020). Pengaruh literasi keuangan, gaya hidup dan pengendalian diri terhadap perilaku konsumtif mahasiswa prodi manajemen fakultas ekonomi Universitas Pasir Pengaraian. Jurnal Ilmiah Manajemen Dan Bisnis, 2(1), 107–118

Ayu, N. D., & Pratiwi, R. S. (2020). Pengaruh Literasi Keuangan dan Minat Menabung terhadap Perilaku Konsumtif Mahasiswa. Jurnal Ilmu Manajemen dan Bisnis, 11(2), 113–120

Burchi, A., Włodarczyk, B., Szturo, M., & Martelli, D. (2021). The effects of financial literacy on sustainable entrepreneurship. Sustainability (Switzerland), 13(9). https://doi.org/10.3390/su13095070

Damayanti, S., & Putri, M. R. (2020). Analisis Literasi Keuangan Siswa SMA dan Dampaknya terhadap Perilaku Konsumsi. Jurnal Pendidikan dan Ekonomi, 9(1), 45–52.

Dewi, A. F., & Sari, R. P. (2022). Pengaruh Literasi Keuangan terhadap Perilaku Konsumtif Mahasiswa. Jurnal Ekonomi dan Bisnis, 14(3), 233–240.

Dewi, V. I., Febrian, E., Effendi, N., & Anwar, M. (2020). Financial literacy among the millennial generation: Relationships between knowledge, skills, attitude, and behavior. Australasian Accounting, Business and Finance Journal, 14(4), 24–37

Fitri, A.D. (2013). Penerapan Strategi Pengelolaan Diri (Self Management) untuk Mengurangi Perilaku Konsumtif pada Siswa Kelas X-11 SMAN 15 Surabaya. UNESA Journal Mahasiswa Bimbingan dan Konseling. Vol. 1 (1): 26-36

Hayati, A., Yusuf, A. M., & Asnah, M. B. (2020). Contribution of Self Control and Peer Conformity to Consumptive Behavior. International Journal of Applied Counseling and Social Sciences, 1(2). https://doi.org/10.24036/005344ijaccs

Hermansson, C., & Jonsson, S. (2021). The impact of financial literacy and financial interest on risk tolerance. Journal of Behavioral and Experimental Finance, 29. https://doi.org/10.1016/j.jbef.2020.100450

Hikmah, Y. (2020). Literasi Keuangan pada Siswa Sekolah Dasar di Kota Depok, Provinsi Jawa Barat, Indonesia. Jurnal Pengabdian Kepada Masyarakat, 26(2), 103–108

Iradianty, A., & Azizah, P. Z. (2023). Analisis Pengaruh Literasi Keuangan, Sosialisasi Keuangan Keluarga, dan Uang Saku Terhadap Minat Menabung pada Siswa Usia Remaja Kota Yogyakarta. Jurnal Orientasi Bisnis Dan Entrepreneurship (JOBS), 4(1), 13–22

Jasman, Jasman, Anggi Fitria, Thaheransyah Thaheransyah, and Sri Sugita. (2022). Penerapan Layanan Bimbingan Kelompok Untuk Meningkatkan Pemahaman Mahasiswa Tentang Perilaku Konsumtif.” Islamic Counseling: Jurnal Bimbingan Konseling Islam 6(1): 123.

Kadoya, Y., & Khan, M. S. R. (2020). What determines financial literacy in Japan. Journal of Pension Economics and Finance, 19(3). https://doi.org/10.1017/S1474747218000379

Kumalasari, D., & Soesilo, Y. H. (2019). Pengaruh literasi keuangan, modernitas individu, uang saku dan kontrol diri terhadap perilaku konsumtif mahasiswa prodi S1 pendidikan ekonomi angkatan tahun 2016 fakultas ekonomi Universitas Negeri Malang. Jurnal Pendidikan Ekonomi, 12(1), 61–71.

Lone, U. M., & Bhat, S. A. (2024). Impact of financial literacy on financial well-being: a mediational role of financial self-efficacy. Journal of Financial Services Marketing, 29(1). https://doi.org/10.1057/s41264-022-00183-8

Lusardi, A., & Mitchell, O. S. (2014). The Economic Importance of Financial Literacy: Theory and Evidence. Journal of Economic Literature, 52(1), 5–44.

Mauludin, Mauludin, Okianna Okianna, and Husni Syahrudin. (2021). Analisis Perubahan Perilaku Konsumtif Pada Mahasiswa Perantau (Studi Kasus Mahasiswa Pendidikan Ekonomi FKIP UNTAN). Jurnal Pendidikan dan Pembelajaran Khatulistiwa (JPPK) 10(3)

Muawaliyah, W., & Saifuddin, A. (2023). Consumptive Behavior in Female University Students: Qana’ah and Hedonic Lifestyle as Predictors. Islamic Guidance and Counseling Journal, 6(1). https://doi.org/10.25217/igcj.v6i1.3241

Nababan, D., & Sadalia, I. (2013). Personal Financial Literacy and Financial Behavior of College Students: Evidence from Indonesia. Journal of Business and Management, 3(5), 45–52.

Novianus, Y. (2023). Konsumtif: Indikator, Faktor, Dampaknya Dan Tips Mengatasinya. Cermati.

Nur, Anisa Fauzia dan Nurdin. (2019). Pengaruh Literasi Keuangan terhadap Perilaku Konsumtif. Universitas Islam Bandung

Priansa, D. J. (2017). Perilaku Konsumen dalam Persaingan Bisnis Kontemporer. (M. A. Firsada, Ed.) (1st ed.). Bandung: ALFABETA, CV

Putri, R., & Siregar, Q. R. (2022). Pengaruh Pengetahuan Keuangan, Sikap Keuangan Dan Literasi Keuangan Terhadap Perilaku Manajemen Keuangan Pada Pelaku UMKM Ayam Penyet Di Desa Laut Dendang. Jurnal Akmami (Akuntansi Manajemen Ekonomi), 3(3), 580- 592

Rahmatika, A. F., & Kusmaryani, R. E. (2020). Relationship between Conformity and Consumptive Behavior in Female Adolescents. Humaniora, 11(3). https://doi.org/10.21512/humaniora.v11i3.6567

Razen, M., Huber, J., Hueber, L., Kirchler, M., & Stefan, M. (2021). Financial literacy, economic preferences, and adolescents’ field behavior. Finance Research Letters

Razi, S., Syahrudin, H., & Budiman, J. (2023). Pengaruh Literasi Keuangan, Uang Saku, dan Gaya Hidup Terhadap Minat Menabung Mahasiswa Pendidikan Ekonomi FKIP Untan. Jurnal Edukasi Ekonomi, 1(1), 1–9

Sari, Y. R., & Yuliana, R. (2021). Hubungan Minat Menabung dan Gaya Hidup Konsumtif pada Remaja. Jurnal Psikologi Ulayat, 8(1), 90–101.

Sekita, S., Kakkar, V., & Ogaki, M. (2022). Wealth, Financial Literacy and Behavioral Biases in Japan: the Effects of Various Types of Financial Literacy. Journal of the Japanese and International Economies, 64. https://doi.org/10.1016/j.jjie.2021.101190

Silalahi, R. Y. B. (2020). Pengaruh literasi keuangan dan gaya hidup terhadap perilaku konsumtif berbelanja online. Khazanah Ilmu Berazam, 3(2), 191–200.

Downloads

Published

How to Cite

Issue

Section

Categories

License

Copyright (c) 2025 Henry J.D. Tamboto, Listriyanti Palangda

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Authors who publish with this journal agree to the following terms:

- Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution-ShareAlike that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgement of its initial publication in this journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See The Effect of Open Access).