Foreign Investment and Stock Market Development in Indonesia

DOI:

https://doi.org/10.59653/ijmars.v2i02.656Keywords:

Foreign Investment, FDI, FPI, Capital Market, Market CapitalizationAbstract

The Indonesian capital market is growing and is significantly influenced by domestic and international macroeconomic factors. Foreign investment is one of the worldwide factors considered to affect the growth of Indonesia's capital markets. The objective of this study is to investigate the impact of foreign investor in term of Foreign Direct Investment (FDI) and Foreign Portfolio Investment (FPI) on the value of Indonesian stock market capitalization (MarCap). This study utilized a quantitative-descriptive research approach. Annual time series for 21 years starting from 2000 to 2020 of FDI, FPI, and MarCap data utilized. Data processing uses SPSS-25 which includes Classical Assumption Test, Multiple Linear Regression, Coefficient of Determination Test, and t-test. The findings of current study prove that both FDI and FPI have a favorable and statistically significant influence on the development of stock market capitalization in Indonesia. The study implies that the government must formulate regulation which encourages macroeconomic stability and appropriate policies to attract more foreign investors to participate in Indonesia and contribute to the development of the stock market.

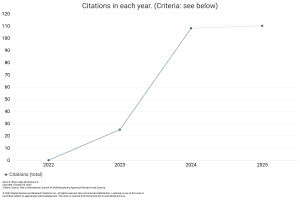

Downloads

References

Acheampong, I. K., & Wiafe, E. A. (2013). Foreign direct investment and stock market development: Evidence from Ghana. International Journal of Finance and Policy Analysis 5, 5(1), 3–15.

Al Samman, H., & Jamil, S. A. (2018). The impact of foreign direct investment (FDI) on stock market development in GCC countries. Pertanika Journal of Social Sciences and Humanities, 26(3), 2085–2100.

Almumani, M. A. Y. (2018). An empirical study on effect of profitability and market value ratios on market capitalization of infrastructural companies in India. International Journal of Business and Social Science, 9(4), 39–45. https://doi.org/10.30845/ijbss.v9n4p6

Chhimwal, B., & Bapat, V. (2020). Impact of foreign and domestic investment in stock market volatility: Empirical evidence from India. Cogent Economics and Finance, 8(1), 1–14. https://doi.org/10.1080/23322039.2020.1754321

Duasa, J., & Kassim, S. H. (2009). Foreign portfolio investment and economic growth in Malaysia. Pakistan Development Review, 48(2), 109–123.

Eniekezimene, F. A. (2013). The impact of foreign portfolio investment on capital market growth: evidence from Nigeria. Global Business and Economics Research Journal, 2(8), 13–30.

Ezeanyeji, C. I., & Maureen, I. (2019). Foreign portfolio investment on economic growth of Nigeria: An impact analysis. International Journal of Academic Management Science Research (IJAMSR), 3(3), 24–36.

Haris, M., Tan, Y., Malik, A., & Ain, Q. U. (2020). A study on the impact of capitalization on the profitability of banks in emerging markets: A case of Pakistan. Journal of Risk and Financial Management, 13(9), 1–21. https://doi.org/10.3390/jrfm13090217

IMF. (1993). Balance of Payments Manual. https://doi.org/10.2307/2549626

Indonesia Stock Exchange. (2020). Annual Report IDX 2020. In Annual Report IDX. https://www.idx.co.id/media/1210/2015.pdf

Kumar, M. P., & Kumara, N. V. M. (2020). Market capitalization: Pre and post COVID-19 analysis. Materials Today: Proceedings, 37(2), 2553–2557. https://doi.org/10.1016/j.matpr.2020.08.493

Makoni, P. L., & Marozva, G. (2018). The nexus between foreign portfolio investment and financial market development: Evidence from Mauritius. Academy of Strategic Management Journal, 17(5), 1–14.

Masoud, N. M. H. (2013). The impact of stock market performance upon economic growth. International Journal of Economics and Financial Issues, 3(4), 788–798.

Musa, S. U., & Ibrahim, M. (2014). Stock market development , foreign direct investment and macroeconomic stability: Evidence from Nigeria. Research Journal of Finance and Accounting, 5(18), 258–264.

Nieuwerburgh, S. Van, Buelens, F., & Cuyvers, L. (2006). Stock market development and economic growth in Belgium. Explorations in Economic History, 43(1), 13–38. https://doi.org/10.1016/j.jeconbus.2014.03.002

Nordin, S., & Nordin, N. (2016). The impact of capital market on economic growth: A Malaysian outlook. International Journal of Economics and Financial Issues, 6(7Special Issue), 259–265.

Nyanaro, E., & Elly, D. (2017). The relationship between stock market performance and economic growth in the East African community. African Development Finance Journal, 1(1), 110–132.

Onyeisi, O., Samuel, A., Odo, Stephan, I., Anoke, A., & Ifeyinwa, C. (2016). Foreign portfolio investment and stock market growth in Nigeria. Developing Country Studies, 6(11), 64–76. https://doi.org/10.17010/ijf/2015/v9i1/71535

Rezagholizadeh, M., Aghaei, M., & Dehghan, O. (2020). Foreign direct investment, stock market development, and Rrenewable energy consumption: Case study of Iran. Journal of Renewable Energy and Environment, 7(2), 8–18. https://doi.org/10.30501/jree.2020.105913

Shahbaz, M., Lean, H. H., & Kalim, R. (2013). The impact of foreign direct investment on stock marketdevelopment: Evidence from Pakistan. Ekonoms Ka Istraživanja- Economic Research, 26(1), 17–32.

Siska, E., & Arigawati, D. (2019). Pengaruh Investasi Portofolio Asing dan Variabel Makro Ekonomi Terhadap Perkembangan Pasar Saham Indonesia. Media Riset Bisnis & Manajemen, 18(1), 30–42. https://doi.org/10.25105/mrbm.v18i1.4989

Siska, E., Duraipandi, O., & Widodo, P. (2023). Determinants of Indonesian stock market development: Implementation of an ARDL bound testing approach. Investment Management and Financial Innovations, 20(4), 69–82. https://doi.org/10.21511/imfi.20(4).2023.07

Topaloglu, E. E., Sahin, S., & Ege, İ. (2019). The effect of foreign direct and portfolio investments on stock market returns in E7 countries. The Journal of Accounting and Finance, 83(3), 263–278. https://doi.org/10.25095/mufad.580166

Uddin, G. S., Sjö, B., & Shahbaz, M. (2013). The Causal Nexus between Financial Development and Economic Growth in Kenya. Economic Modelling, 35(June 2011), 701–707. https://doi.org/10.1016/j.econmod.2013.08.031

Downloads

Published

How to Cite

Issue

Section

Categories

License

Copyright (c) 2024 Elmira Siska, Oyyappan Duraipandi, Lina Tio, Ali Ameen

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Authors who publish with this journal agree to the following terms:

- Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution-ShareAlike that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgement of its initial publication in this journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See The Effect of Open Access).