Influence of Inventory Turnover, Receivable Turnover, and Sales Growth on Profitability with Good Corporate Governance as a Moderating Variable

Companies with Trading and Distribution Business Sectors Listed on the Indonesian Stock Exchange for 2020 - 2022 Period

DOI:

https://doi.org/10.59653/ijmars.v2i03.902Keywords:

Inventory Turnover, Receivable Turnover, Sales Growth, Independent Board, Commissioners and ProfitabilityAbstract

This research aims to examine and analyze the influence of inventory turnover, receivable turnover and sales growth partially and simultaneously on ROA in trading and distribution business companies listed on the Indonesia Stock Exchange. The population in this research are trading and distribution business companies listed on the Indonesia Stock Exchange. The sampling technique used in this research was the purposive sampling method and 12 companies were obtained. The analysis technique in this research uses multiple linear regression analysis techniques and Moderated Regression Analysis (MRA) using the SPSS 29 program. The results of this research conclude that inventory turnover has an effect on profitability while receivable turnover and sales growth have no effect on profitability. While the Independent Board of Commissioners can significantly influence the relationship between inventory turnover and profitability, the Independent Board of Commissioners cannot influence or is unable to moderate the relationship between receivable turnover and sales growth and profitability.

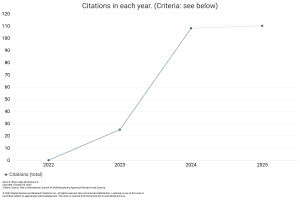

Downloads

References

Brigham, & Houston. (2012). Esensi Manajemen Keuangan. Dasar-dasar Manajemen Keuangan (11th ed.). Salemba Empat.

Darmawan, & Deni. (2016). Metode Penelitian Kuantitatif. PT. Rosdakarya Teenager.

Ersandi Yusup, W. (2024). The Effect of Receivables Turnover, Inventory Turnover and Current Ratio on Profitability. 10(1), 53–54.

Farhana. (2016). Pengaruh perputaran persediaan dan pertumbuhan penjualan terhadap profitabilitas. Bisma e-Jurnal, Ganesha. Bisma E-Journal, Ganesha University of Education, Department of Management.

Franita. (2018). Mekanisme Tata Kelola Perusahaan dan Nilai-Nilai Perusahaan. Lembaga Penelitian dan Penulisan Ilmiah AQLI.

Ghozali, I. (2016). Aplikasi analisis multivariete: dengan program IBM SPSS 23. Badan Penerbit Universitas Diponegoro.

Hayati, K., Lumban Gaol, R. F., Sianturi, I. P. S., & Sagala, Y. M. (2019). Pengaruh Inventory Turnover, Sales Growth, dan Liquidity Terhadap Profitabilitas pada PT. Sumber Alfaria Trijaya Tanjung Morawa Periode 2013-2017. Owner, 3(1), 128. https://doi.org/10.33395/owner.v3i1.111

Hernando, R. (2019). The Effect of Information Asimmetry On Earnings Management In Companies That Conduct An Initial Public Offering (IPO) On The Indonesia Stock Exchange (IDX). Jurnal Manajemen Dan Bisnis Sriwijaya, 16(4), 222–236. https://doi.org/10.29259/jmbs.v16i4.7668

I Gusti Ayu Kade Sri Wahyuniati, & I Ketut Yudana Adi. (2021). Pengaruh Pertumbuhan Penjualan, Perputaran Kas, Perputaran Piutang, Dan Perputaran Persediaan Terhadap Profitabilitas Pada Perusahaan Subsektor Makanan & Minuman Di Bursa Efek Indonesia. Journal Research of Accounting, 2(2), 219–235. https://doi.org/10.51713/jarac.v2i2.39

Kariyoto. (2018). Konsep dan implementasi manajemen keuangan. UB Press TEAM.

Lauw, & Linda. (2017). Pengaruh Perputaran Kas, Perputaran Piutang, dan Perputaran Persediaan Terhadap Return On Assets Pada Perusahaan Sektor Makanan Dan Minuman Yang Terdaftar Di Bursa Efek Indonesia Periode 2013 - 2015. Jurnal Akuntansi, 9(1), 74–82.

Maryam, & Yuyetta. (2019). Analisis Pengaruh Mekanisme Corporate Governance Terhadap Probabilitas Financial Distress. Diponegoro Journal of Accounting, 8, 1–11.

Mayasari, V., Ekonomi, F., Nusantara, U., Guru, P., Indonesia, R., & Kediri, U. N. P. (2016). Pengaruh Vash Turn Over, Receivable Turn Over, Inventory Turn Over, Working Capitas Turn Over Terhadap Likuiditas Pada Perusahaan Manufaktur Sektor Industri Barang Konsumsi yang Terdaftar di BEI Tahun 2012-2014.

Meidiyustiani, R. 2016. (2016). Pengaruh Modal Kerja, Ukuran Perusahaan, Pertumbuhan Penjualan, Dan Likuiditas Terhadap Profitabilitas Pada Perusahaan Manufaktur. Jurnal Akuntansi Dan Keuangan, 5(2), 131–143.

Moeljadi dan Supriyati, T. S. (2014). Factors Affecting Firm Value: Theoretical Study On Public Manufacturing Firms In Indonesia. South East Asia Journal of Contemporary Business, Economics and Law, 5(2), 6–15.

Nurafika, R. A. (2018). Pengaruh Perputaran Kas, Perputaran Piutang, Perputaran Persediaan Terhadap Profitabilitas Pada Perusahaan Semen. JURNAL AKUNTANSI DAN BISNIS : Jurnal Program Studi Akuntansi, 4(1). https://doi.org/10.31289/jab.v4i1.1532

Sugiyono. (2017). Metode Penelitian Kuantitatif, Kualitatif dan R&D. Alfabeta.

Sukaenah. (2020). Pengaruh Perputaran {iutang, Perputaran Persediaan dan Pertumbuhan Penjualan Terhadap Profitabilitas Perusahaan di Bursa Efek Indonesia. 1–17.

Suyanti. (2021). Program studi akuntansi fakultas ilmu sosial dan humaniora universitas putera batam tahun 2021.

Wiralestari, W. (2021). The Use Of Information Technology In Improve The Quality Of Financial Reporting In Micro, Small and Medium Enterprises.

Yanti, Y., & Maemunah, M. (2020). Pengaruh Perputaran Piutang dan Perputaran Persediaan terhadap Profitabilitas (Studi Empiris pada Perusahaan Sektor Industri Barang Konsumsi yang Terdaftar di BEI Periode 2015-2018). Akuisisi: Jurnal Akuntansi, 16(1), 39–43. https://doi.org/10.24127/akuisisi.v16i1.448

Downloads

Published

How to Cite

Issue

Section

Categories

License

Copyright (c) 2024 Fatmawati, Wiralestari, Riski Hernando

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Authors who publish with this journal agree to the following terms:

- Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution-ShareAlike that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgement of its initial publication in this journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See The Effect of Open Access).